Cyber Risk Is Being Misunderstood — And It’s Costing Organisations Far More Than They Realise

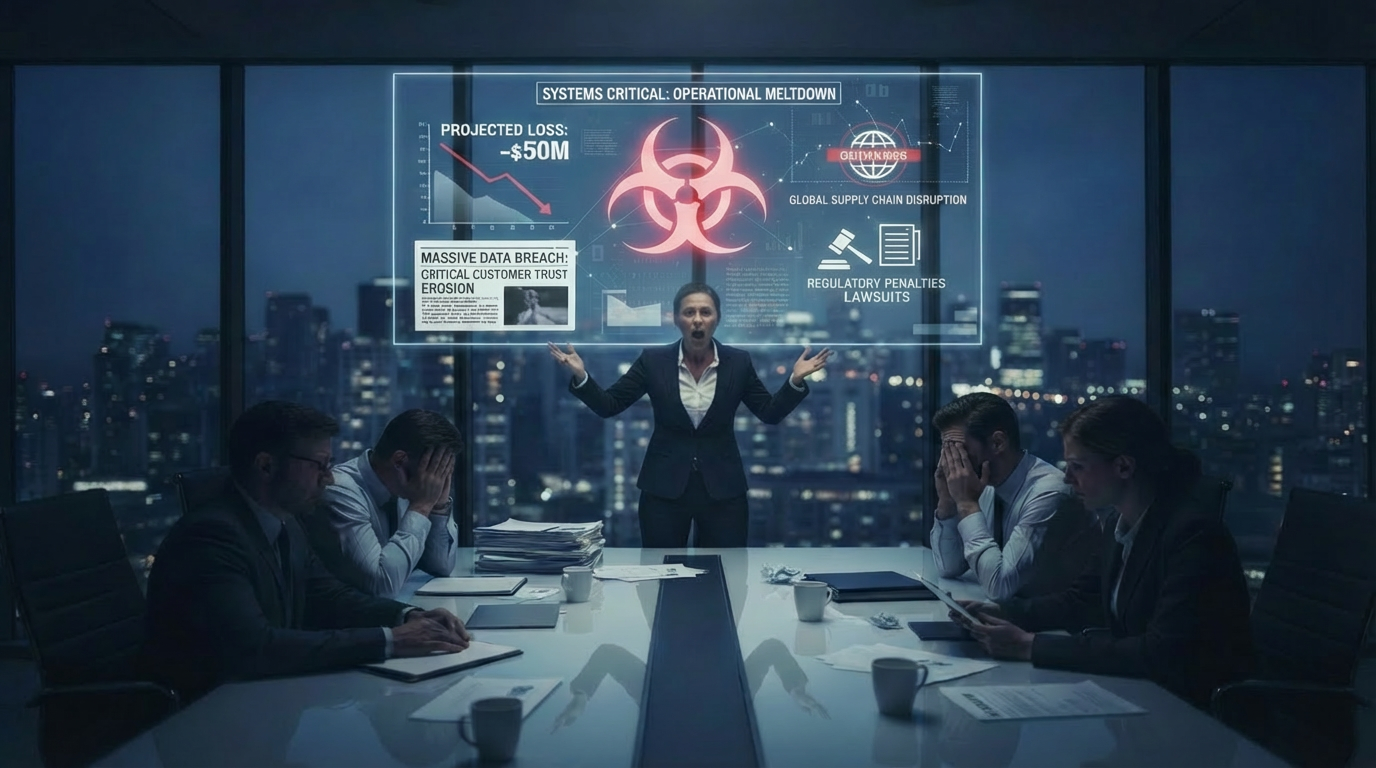

2025 has been the year of the mega hack, with even respected brands falling victim. In response, across every sector, organisations are investing more in cyber security than ever before. Despite this, incidents continue to escalate in frequency, scale and impact. High-profile breaches dominate the headlines, but behind them sits a quieter and more damaging trend: many organisations still do not share a common understanding of what cyber risk actually means.

Boards sign off cyber strategies. Executives approve budgets. Technical teams implement controls. And yet, when something goes wrong, it becomes clear that each group was working to a different definition of risk.

This misunderstanding of risk undermines the governance structures designed to manage those threats. And an ongoing misconnect between cyber governance and commercial governance.

Is your organisation aligned on cyber risk?

When organisations lack a shared understanding of risk, the consequences are predictable.

It leads to misdirected investment, slow decision-making in a crisis, and in some cases, disaster. The uncomfortable truth is that many organisations believe they are managing cyber risk effectively — but are doing so using incompatible assumptions.

Boards receive dense, technical reports that are difficult to interpret. Security teams focus on vulnerabilities and compliance artefacts that do not translate into business insight. Investment decisions become reactive rather than strategic, often driven by regulatory anxiety or the latest incident in the news cycle.

In Bee-net’s work with large enterprises, infrastructure operators and investors, we repeatedly see the same pattern:

Cyber security is treated as a technical discipline rather than a business capability.

Decision-makers struggle to compare cyber risks with other types of risk (or, worse, manage them entirely separately)

Significant effort is spent on audits and assurance, yet there is no measurable improvement in business value protection

The result is a paradox: organisations spend more on cyber security while feeling less in control of it.

This is not a failure of technology. It is a failure of alignment.

The alternative: redefining cyber risk in business terms

The turning point for many organisations comes when they revisit a deceptively simple question: What do we actually mean by risk?

Rather than inventing new frameworks, the most effective organisations adopt the definition already embedded in international standards such as NIST SP 800-30, ISO 31000 and ISO 27001:

Risk is the effect of uncertainty on objectives.

This definition matters because it reframes cyber security as a business issue, not a technical one. It shifts attention from lists of vulnerabilities to the outcomes the organisation is trying to protect — revenue, safety, service continuity, reputation, or strategic growth.

When risk is defined this way:

Cyber conversations align naturally with board priorities.

Trade-offs become explicit and easier to govern.

Technical detail supports decision-making instead of obscuring it.

In practical terms, this means asking different questions. Instead of ‘is this system compliant?’ we ask “what would failure here mean for our ability to deliver our objectives?” Instead of ‘is a control in place?”: “Is the risk acceptable?”

This shift sounds subtle, but in practice it is transformative.

What happens when organisations make this shift?

At Bee-Net, we have helped organisations to apply this approach applied across defence, critical national infrastructure, finance and investment portfolios, as part of our Cyber Maturity Accelerator™.

In each case, the impact is similar:

Boards gain confidence because cyber discussions align with strategic and financial language they already use.

Executives make better decisions as trade-offs between cost, risk and opportunity become explicit.

Security teams become enablers, focusing on outcomes rather than compliance theatre.

Regulatory engagement improves, because organisations can clearly articulate how risks are identified, assessed and managed.

In one PE portfolio, aligning cyber risk with business risk allowed leadership teams to make meaningful comparisons across different companies and focus attention on relationship building, enabling senior leadership teams in portfolio companies to make better investment choices. In another example nuclear-powered critical national infrastructure was enabled to move from reactive compliance to proactive resilience — with measurable improvements in governance and confidence.

None of this required more tools or heavier controls. What changed was the shared understanding of risk.

A final thought

Cyber risk does not need to be complex, abstract or intimidating. When defined clearly and consistently, it becomes a practical management tool — one that supports better decisions, stronger governance and long-term resilience.

Organisations that make this shift stop asking, “Are we compliant?” and start asking, “Are we making the right choices?”

That is where real cyber maturity begins.

Next Steps

Need help in measuring your cyber maturity or want to know where you stand in relation to your peers? Get in touch below.